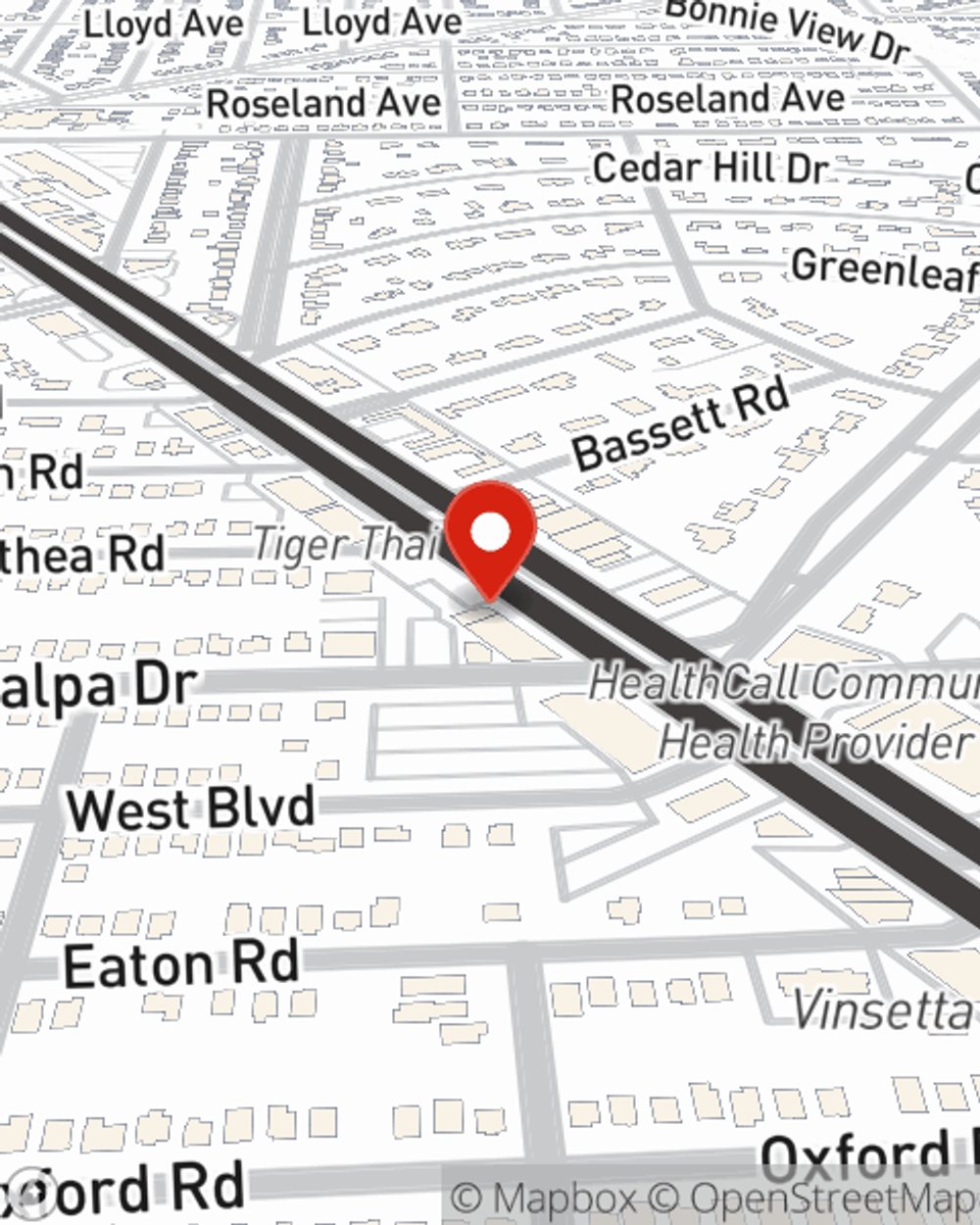

Renters Insurance in and around Berkley

Berkley renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Royal Oak

- Troy

- Southfield

- Birmingham

- Ferndale

- Oak Park

- Warren

- Oakland County

- Macomb County

- Pleasant Ridge

- Hazel Park

- Ann Arbor

- Sterling Heights

- Shelby Township

Home Sweet Home Starts With State Farm

It may feel like a lot to think through family events, managing your side business, your sand volleyball league, as well as coverage options and deductibles for renters insurance. State Farm offers hassle-free assistance and impressive coverage for your swing sets, cameras and souvenirs in your rented house. When the unexpected happens, State Farm can help.

Berkley renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

You may be wondering: Do you really need renters insurance? Just pause to consider the cost of replacing your possessions, or even just a few of your high-value items. With a State Farm renters policy by your side, you don't have to worry about windstorms or tornadoes. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Matt Arce can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a committed provider that can help you protect your belongings and save, get in touch with State Farm agent Matt Arce today.

Have More Questions About Renters Insurance?

Call Matt at (248) 544-9020 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.